One of the most important aspects of operating a business is accounting as there are specific regulations that need to be respected and our accountants in Saudi Arabia are here to help. Starting a business in Saudi Arabia implies completing various steps and procedures before and after the company is incorporated. Moreover, not only companies but also individuals must comply with different accounting obligations.

| Quick Facts | |

|---|---|

| Accounting services available |

– bookkeeping, – financial statement preparation and filing, – tax consulting and advisory etc. |

|

Payroll services availability (YES/NO) |

Yes, payroll and HR services are available with our accountants in Saudi Arabia |

|

VAT registration availability (YES/NO) |

Yes, our accountant in Saudi Arabia can help you obtain a VAT number |

| VAT rates | 5% standard rate |

| Corporate tax rate |

20% |

| Zakat tax rate |

2.5% calculated on the net worth of a company |

| Special tax rules applied to foreign investors |

Foreigners are not imposed the Zakat. |

| Tax allowances availability (YES/NO) |

Yes, costs associated with: – salaries, – retirement contributions paid by employers, – startup expenses |

| Accounting and reporting standards in Saudi Arabia |

International Financial Reporting Standards |

| Audit services availability (YES/NO) | Yes, our auditors in Saudi Arabia can provide audit services |

| Financial statements filing requirements |

120 days after the financial year ends |

| Audited financial statements required (YES/NO) |

Yes |

| Double tax treaties access (approx. number) |

Approx. 55 double tax treaties |

| Personal income tax |

Saudi Arabia does not levy a personal income tax |

| Other services | Apart from our accounting services, we also offer company formation services in Saudi Arabia. |

Our accountants in Saudi Arabia are at the service of those who need assistance in financial matters. We also have a team of specialists in company formation in Saudi Arabia for those interested in doing business here.

Below, we invite you to discover the main accounting regulations and services available in Saudi Arabia. You can rely on our Saudi accountant for extensive information on the services we can provide for you. Our extended team also has immigration lawyers in Saudi Arabia, ready to help you move here.

Accounting services offered by our specialists in Saudi Arabia

Both Saudi nationals and foreign citizens and companies can use the services of accounting firms in Saudi Arabia. Moreover, they can choose between one or more services based on their needs.

Our accountants in Saudi Arabia, for example, can help in the following:

- tax and VAT registration which is a service that can be provided from the beginning of commercial operations in this country;

- bookkeeping which is one of the most important services associated with accounting in Saudi Arabia;

- payroll and human resources administration services which cover accounting and employment-related services and that are very appreciated by foreign investors;

- tax advisory services for business owners who are looking to improve their operations or who are interested in adopting a new direction;

- financial statement preparation and audit services must be completed in accordance with various regulations.

It is possible to use different services from various accounting firms in Saudi Arabia, however, it is recommended to choose the desired one in accordance with your needs.

If you are a foreign investor prospecting the market for opening a company in Saudi Arabia, we can also provide valuable information on how to start a business in the sector you are interested in. If you need more information on accounting in Saudi Arabia, we are at your service. If you need accounting services in other countries, such as UAE, we can put you in touch with our local partner-accountants in Dubai.

If you are interested in immigration to Saudi Arabia and the taxes you need to pay, you can rely on our agents. The Saudi Iqama or residence permit is the main document that enables a foreign citizen to legally live here. If you want to move to this country, there are various requirements to meet, including having a valid reason for relocation. You can rely on our immigration lawyers if you need support in establishing yourself here.

Tax and VAT registration services in Saudi Arabia

Foreign investors who want to open companies in Saudi Arabia should note that one of the final steps in the company registration procedure is the registration for tax and VAT purposes. This will enable the company to engage in commercial activities.

Registration for taxation must be completed with the General Authority of Zakat and Tax. The procedure can be completed by our accountants in Saudi Arabia as part of the company formation procedure. We can also handle the VAT registration formalities and other aspects related to accounting in Saudi Arabia, while our lawyers can advise on immigration to Saudi Arabia.

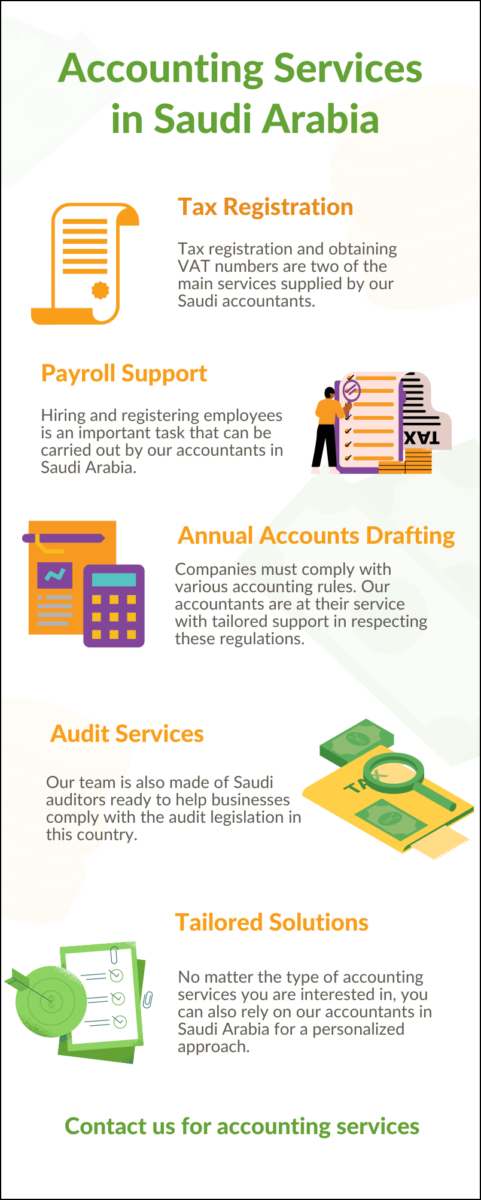

Here is also an infographic on our accounting services in Saudi Arabia:

Bookkeeping services for companies in Saudi Arabia

Bookkeeping is one of the most important services sought from accounting firms in Saudi Arabia, as it implies recording all financial documents issued or received by a business on a day-to-day basis. It is also one of the most time-consuming aspects related to the accounting of a business.

If you are interested in externalizing such services, our accountants in Saudi Arabia can help you.

Payroll services in Saudi Arabia

Running a business implies having employees and in Saudi Arabia, there are various regulations that need to be respected in this sense. The Employment Law is one of them, however, having staff also implies having financial responsibilities.

A Saudi company must register for social security and insurance purposes. Employees too must be enrolled with the healthcare and pension systems for which specific procedures must be completed and contributions must be paid.

In order to avoid complications, this part of the accounting in a company in Saudi Arabia can be handled by our accountants. We can also handle the preparation of documents like:

- paychecks;

- payment forms;

- health and social security contributions;

- employment contracts;

- amendments to work contracts;

- annual and sick leave sheets.

Apart from these, we can keep all employee records updated in accordance with the provisions of the law.

If you have any questions on other taxation matters in Saudi Arabia, you can rely on our accountants. They will also provide information on various matters related to accounting in Saudi Arabia.

Accounting services for small companies in Saudi Arabia

Small enterprises usually have simpler accounting requirements when it comes to compliance, however, in terms of day-to-day operations, these will be the same as for any other type of company. This is the case of startups and other companies that enter the category of small businesses.

For these, our accountant in Saudi Arabia can provide tailored assistance when it comes to bookkeeping, accounting, and compliance.

Another important fact to know about small companies is that they usually benefit from various incentives that can be obtained with the help of our specialists. For this purpose, however, our accountants must verify if it meets the requirements imposed by the agency offering the respective incentives.

If you have a small company and need accounting services, you can rely on our specialists for the desired package.

Taxation of foreign investors in Saudi Arabia

As an Islamic state, Saudi Arabia imposes a few taxes on local companies and investors, however, also on those from other GCC countries. Some of these levies are not imposed to foreign investors, such is the case of the Zakat.

The Zakat implies a donation that must be made by each individual and it is calculated based on the wealth of the respective taxpayer. The Zakat is donated for charitable purposes and is collected the Saudi tax authorities. Foreign investors from non-GCC countries will not pay the Zakat.

Another aspect to consider refers to partnerships between Saudi and foreign enterprisers who will pay the taxes in accordance with the provisions regarding the Zakat: Saudi and GCC nationals will pay this levy, while the foreign interested party will only pay the income tax.

Our Saudi accountant can offer specific information on the Zakat and its calculation. It is good to know that in the case of companies, the Zakat is computed as 2.5% of the value of their assets.

Our immigration lawyers in Saudi Arabia are also at your service if you want to open a company in Saudi Arabia as a single foreign entrepreneur or in partnership with a local investor.

Our accountant in Saudi Arabia can help you obtain tax allowances

While some Muslim countries choose to impose no corporate taxes, other enable the income taxation system while also providing for various tax advantages in the form of allowances and deductions. This is also the case of Saudi Arabia where:

- the costs and expenses related to salaries, travel and rentals can be deducted from a company’s tax base;

- employers’ contribution to retirement funds can also qualify for tax deductions;

- startup expenses can also be capitalized or amortized;

- certain debts incurred by companies can also be deducted.

The government enables various ways through which your company can obtain the deductions mentioned above and others, however, there are specific conditions to be met for each of them. These conditions can be explained by our Saudi accountant who can also provide a detailed assessment and see if your company meets these requirements.

Here is also a video on this topic:

Accounting standards applicable in Saudi Arabia

Saudi companies must comply with the International Financial Reporting Standards (IFRS) as implemented by the Saudi Organization for Certified Public Accountants (SOCPA), however, they also have specific reporting requirements (such as those covering the Zakat and other religious levies) that apply in certain cases.

Small and medium-sized enterprises (SMEs) have also transitioned from the SOCPA standards to IFRS a few years ago.

If you need assistance in filing financial documents that meet the IFRS standards, our accountant in Saudi Arabia is at your disposal with specific services. We will also make sure to make all the filings in due time in order to avoid penalties.